NFTs, Luxury & Infringement: What applies where?

NFTs or non-fungible tokens have been making headlines ever since the Indian government announced a 30% tax on all digital assets. So, what really is an NFT? Is it a digital asset?

An NFT:

- Represents the digital form of the signature of the artist and the print number that is associated with the underlying asset

- Is linked to the underlying asset by:

- The digital work; or

- Virtue of a copy of the underlying asset having been encoded in the NFT (which is not very common); or

- The NFT contains a code that links to, or can be used to identify, the digital copy of the artwork or the underlying asset (which is the more common). This is known as “hashing”

NFT is valuable to the company that created it. How valuable, it can be explained in the following quote:

“Owning any digital content is considered as a financial investment that holds some sentimental value and it creates a relationship between collector and creator. For eg. an autograph on a baseball card. Here the NFT is the creator’s autograph on the content which makes it scarce, unique and valuable.”

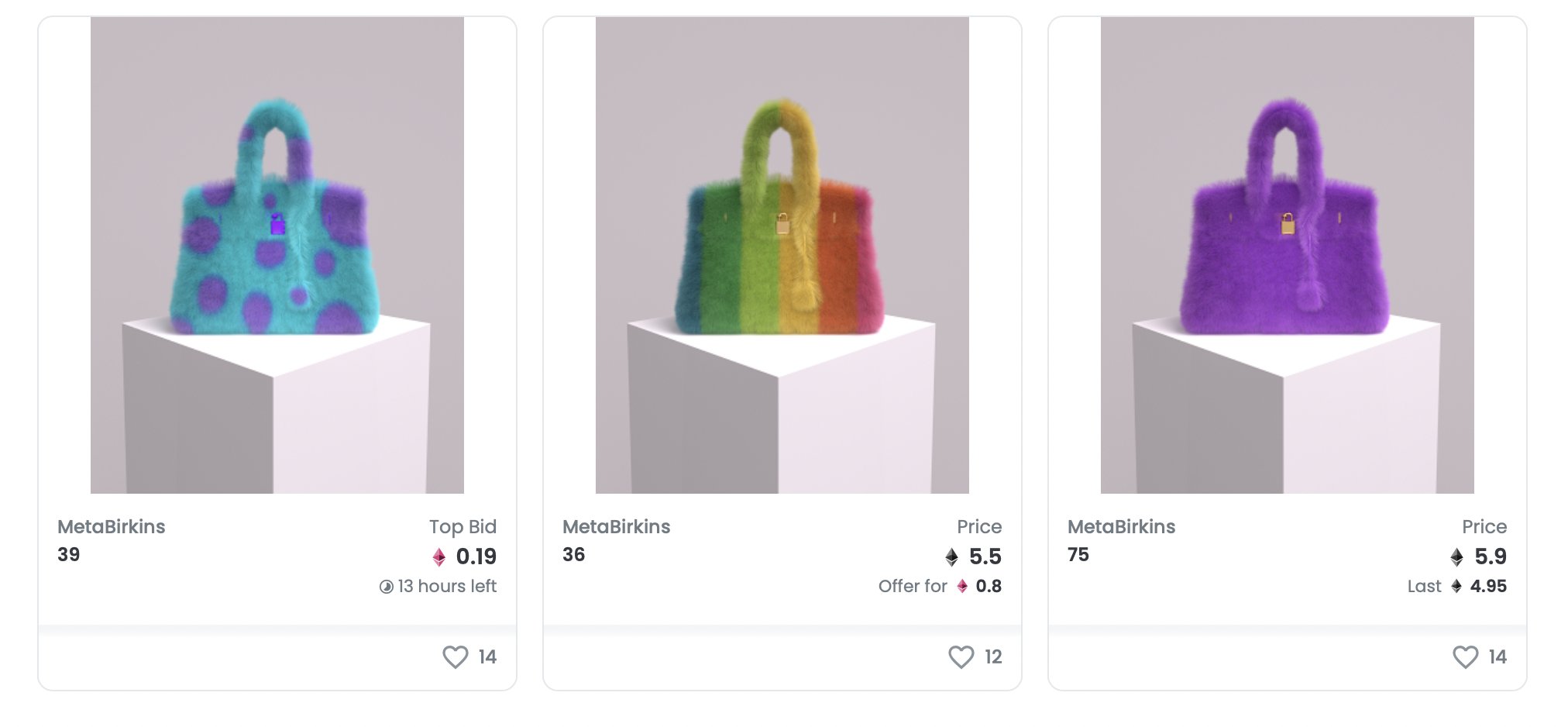

In the case of Rothschild v/s Hermes over and NFT which was similar to the iconic Birkin Bag there are some interesting learnings. Here Rothschild did not make any actual tangible BIRKIN-type bags, but he created digital art inspired by the Hermès brand and wanted to name it as the “MetaBirkins,” featuring a collection of colourful, fashionable tote bags. This caught the attention of the fashion world as the Birkin bag is not only iconic but synonymous with Hermes.

According to the complaint, Hermès claimed that there was a willful infringement as Rothschild only added a generic word “meta” which can create a likelihood of confusion and dilution of Hermes trademark. Such an infringement was not only creating confusion amongst its loyal database of Birkin Bag buyers, but also diluting the brand name and the exclusivity linked to owning a Birkin Bag.

When does the trademark infringement case arise?

Trademark infringement may arise where an unauthorized party mints an NFT linked to the underlying asset, without the asset owner’s permission, and advertises, offers for sale and/or sells the NFT using the asset owner’s registered trademarks.

Why is the Hermes Birkin Special?

Hermès originated in 1837 and became a world-famous designer and producer of high-quality handbags, apparel, scarves, jewelry, fashion accessories, and home furnishings but was famous for the Birkin handbag created in 1984 and first sold in the U.S. in 1986.

The average price of a physical Birkin handbag is around $20,000, but can be sold maximum for $300,000 only due to the value of the Birkin trademark which was valuable.

Arguments of Hermes:

- There was no authorization from Hermes to use the trademark or trade dress from the digital artist i.e Rothschild

- Rothschild clearly profited from the unauthorized use of Hermès trademark, launching over 100 digital collectables under the MetaBirkins mark and earning significant amounts of money from the sale and resale of the NFTs. There were many instances where Rothschild has commercially advertised and sold the MetaBirkins NFTs, including the MetaBirkins website, NFT marketplaces like OpenSea, Rarible, LooksRare, and Zora, as well as Discord, Twitter, and Instagram – all using the aspects of the BIRKIN trademark.

- There was a correlation between BIRKIN and Rothschild’s project when one sees the Instagram and Twitter accounts.

- The MetaBirkins website said that “MetaBirkins are a tribute to Hermes’ famous handbag, the Birkin, one of the most exclusive, well-made luxury accessories”. This showed that Rothschild’s had apparent knowledge of what he was doing, ultimately (mis) leading consumers into believing that there was/is some type of official relationship.

Arguments of Rothschild:

Hermès and other fashion companies have registered to sell perfumes, accessories, garments and in some cases home décor items. But they are not registered to sell digital products. Birkin is a name registered with leather goods, and not in virtual products.

Monetary damages asked by Hermes:

Hermès is seeking monetary damages, including Rothschild’s profits (according to OpenSea that amounts to over 200 Ethereum, around $900,000) and wants Rothschild to transfer the MetaBirkins.com domain to it and to “deliver up for destruction to Hermès all unauthorized products and advertisements in his possession or under his control bearing any of Hermès’ Federally Registered Trademarks or any simulation, reproduction, counterfeit, copy or colorable imitation.”

After creating an NFT, storage and exchange of the digital assets turn into the execution of ‘smart contracts.’ A smart contract can be understood as software codes linked with the NFT, containing details, rules, and rights of the underlying asset attached to the NFT, such as song royalty payments, a bond, an invoice, etcetera. This allows the original creator of the token to gain monetarily and also receive payments from the NFT buyers in the future. This process is known as “Tokenization.” NFTs are stored on the blockchain where records cannot be altered once they are entered.

Conclusion:

Hermès may have arranged a solution rather than getting angry at not having thought about such an idea before Rothschild. The case teaches us that artists should be more careful and aware of copyright issues. Companies should also realize that artists, independent designers and bootleggers quite often may have better ideas and so the companies should collaborate and not involve themselves in such complex litigation.

References:

- https://www.mondaq.com/india/fin-tech/1132188/nft-and-its-relationship-with-ipr#:~:text=Nevertheless%2C%20NFTs%20do%20not%20automatically,or%20assets%20within%20the%20NFT.

- https://www.nortonrosefulbright.com/en/knowledge/publications/1a1abb9f/nfts-and-intellectual-property-rights

- https://finance.yahoo.com/news/nike-herm-sue-trademark-infringement-191735471.html

- https://www.irenebrination.com/irenebrination_notes_on_a/2022/01/hermes-vs-metabirkin.html

- https://beincrypto.com/hermes-sues-mason-rothschild-metabirkins-nft-trademark-infringement/